Frequently Asked Questions

Learn more about Investment Mechanics, our Winning Strategy, and the FEP Team.

FAQs about Investing

Since 2000 Real Estate has outperformed the stock market approximately 2 to 1 earning 10.71% annually vs. 5.43% for stocks.

Why would I want to invest with Frontier Equity Partners?

There are many reasons to invest in real estate. Perhaps the biggest reason is that real estate is one of the most stable investments a person can make. As investment experts know, real estate is often regarded as an asset with an ability to withstand volatile market movements, and as a hard asset, it can serve as a diversification of investments and as a hedge against inflation. Additionally, rather than only having one source of income, investing in real estate can offer an additional way to invest and make money. Real estate investment also offers the opportunity to establish expenses and other activities that might reduce tax obligations and offset earnings.

Who is our ideal investor?

Our ideal investor is a financially qualified individual who is comfortable investing in illiquid real estate and wants some of the benefits of real estate investing, including cash flow, amortization, appreciation, and depreciation.

How do investments work with Frontier Equity Partners?

All deals vary but the general mechanics of the investment are fairly straightforward. An initial investment is made. It is anticipated that, by the second year, the investor begins to receive monthly checks from the building’s profits. In addition to the cash flow, investors will share in property appreciation, amortization, and depreciation.

How much can I invest with Frontier Equity Partners?

Generally, our minimum investment requirement is $50,000. The maximum investment in a single deal would be the total fundraise amount still outstanding.

What do I get from my investment?

From your investment, you receive a piece – a pro-rata share – of the company that owns a specific property. This entitles you to share in the financial benefits of that company.

What are the general risks of these types of investments?

Though real estate can be considered a stable or smart investment, as with any investment, general market fluctuations or outside economic forces can affect returns. To learn more about these risks, please review the Private Placement Memorandum associated with each deal in our investment portal.

How do the tax benefits work?

The tax benefits work through depreciation. There will generally be a tax benefit to this type of investment, but the level of benefit is going to be dependent on each investor’s particular situation. Refer to your CPA or accountant to learn what level of benefit you can expect.

Can I hold this in a tax-advantaged account?

Sometimes, but you should refer to your CPA or accountant for more details.

How is this different than the stock market?

When you invest in a multifamily deal with us you’re buying a part of a business, like you would in the stock market. However, while the stock market only gives you the potential benefit of increased value as the stock fluctuates up and down, we provide four ways to make money, through direct cash flow, amortization, appreciation and depreciation.

FAQs about Strategy

What is our business plan?

Our business plan is to acquire value-add multifamily assets in emerging markets. This means that we will buy properties with an upside and find ways to make them more profitable. Sometimes this can be done through renovations and rent increases, and sometimes simply by finding ways to decrease costs – all fairly standard practices in the industry.

Each business plan is property specific; targeted capital improvements and strong hands-on management throughout the hold period maximize asset value and investor returns.

What kind of properties do you look for?

We are interested in medium-sized multifamily properties located in emerging markets and submarkets – places with strong growth metrics such as job and salary growth and family formation.

Why do you focus on multifamily deals?

Multifamily rental rates exceeded those in the office and industrial sectors during the 2001 recession and all major property sectors, including office, industrial, and retail, during the 2008-2009 recession. It takes less time & energy to acquire 100 apartment units versus 100 single-family residents- much better ROI on your time. With lower costs per door, management is more effective and profitable.

Additionally, Multifamily investing is classified as passive income and offers the most tax deductions.

How do you source deals?

Our primary source is off-market deals.

What size deals do you do?

Most of our deals are multifamily properties with 50+ units.

What is the legal structure?

Each of our deals is typically structured as a Single Purpose Entity (SPE) LLC.

How do you intend to improve communities and value of life in St. Louis neighborhoods?

A visually appealing community increases property values, attracts businesses, and improves the neighborhood's image. Beauty is one of the three most influential factors in community attachment, which means loyalty, to your particular town or city. Some research even shows that a nice-looking neighborhood promotes good behavior.

Overall, community beautification is important also because it makes a statement: someone cares about this place. We all want to feel that someone is watching out for an urban or suburban place that we frequent.

What fees does FEP typically charge and what are they for?

In general, these fees are used to fuel the operations of Frontier Equity Partners.

- Acquisition Fee:

- Structured into each deal are Acquisition fees for us to find the property and acquire a loan.

- Asset Management Fee:

- Once the property is acquired we also receive an asset management fee. This is a portion of the total revenue for finding, hiring, and oversight of the property management company.

- Capital Transaction Fee,

- The Capital Transaction fee is applied when a property is either sold or refinanced.

How does FEP make money?

We make money the same way you do, through carried interest. In other words, we invest some of our own money in every deal, so we’ll be sharing the risks and benefits of each deal alongside you.

Who buys your properties once you’ve improved them, and why?

After we’ve improved our properties we generally sell to other real estate investors or institutional investment groups. Other people will usually purchase properties from us for the same reason we bought them originally – because they see an upside to them. This is because we tend to follow the age-old rule in real estate to “leave a little meat on the bone.” In other words, rather than doing 100% of the potential renovations, we may only do 50%, leaving some potential for the next owner. However, not all potential buyers are interested in value-add properties, and when it makes sense, we may also finish renovations and sell to a buy-and-hold investor.

Underneath it all, what are the core factors I’m really betting on?

At the end of the day you’re betting on our team – our ability to predict market trends and find and evaluate properties, as well as our ability to execute the business plans we put in place for our newly acquired assets.

Whether you are an experienced real estate investor or investing in your first property, we hope you choose Frontier Equity Partners for your next investment and see what our team can do for you.

FAQs about our Team

What is the history of the FEP team?

We are a team of entrepreneurs with expertise in construction, renovations, property management, technology, and systems management. We are also friends and long-time business partners who have built multiple successful businesses together since 2008. We’re always innovating, and at FEP, we combine our knowledge of commercial multifamily and hospitality construction with our knowledge of technology and the big data industry for what we believe are some pretty impressive results.

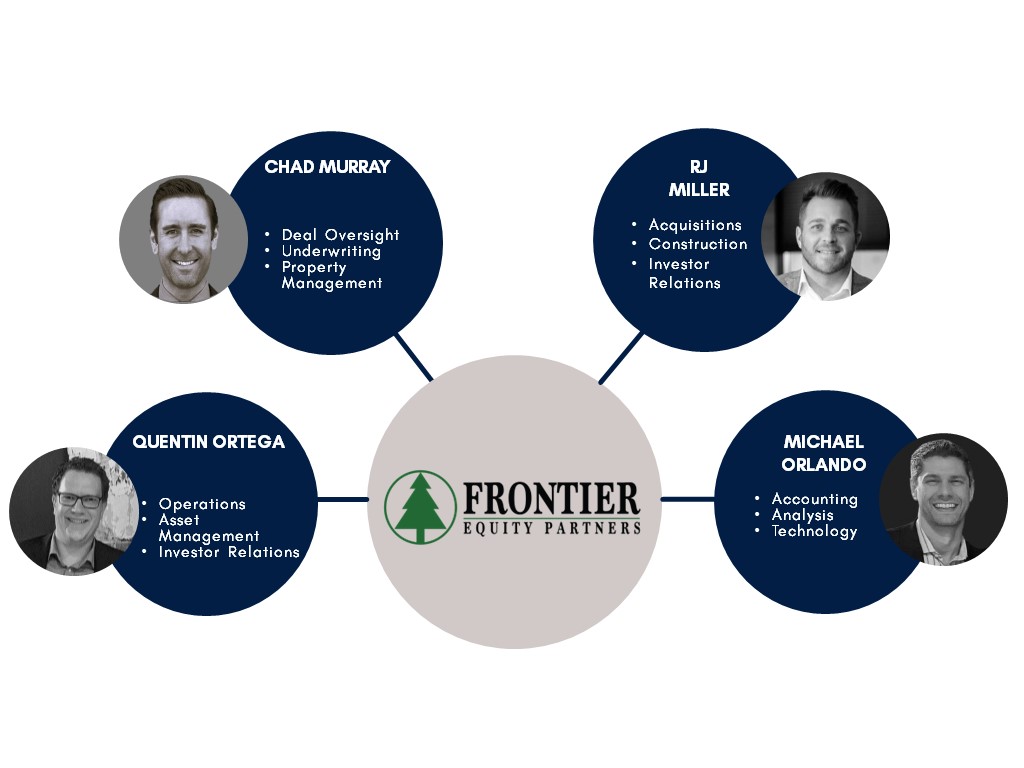

How are the partners structured within FEP?

The org chart to the right shows how we have divided responsibilities. Chad Murray is our Managing Director and will have direct involvement during the underwriting and due diligence process along with final decision-making responsibility.

Your main point of contact will be RJ Miller who is responsible for acquisitions, construction, and investor relations.

What sets Frontier Equity Partners apart?

It starts with choosing the right market, the right properties, and the right buyers. Offering fair market value, 100% transparency from start to finish, extreme professionalism, and candor – then closing on the transaction as promised. We pride ourselves on doing the right thing. That includes investing with transparency and certainty, just like we say we will.

We want to make sure you as the seller are comfortable with the transaction at all times. Once we are under contract, we will communicate at every step so there are never any questions about where we are in the purchasing process. We pride ourselves on doing the right thing. That includes investing with transparency and certainty, just like we say we will.

What is your competitive advantage over other similar private offerings?

While there are several other private offerings out there, we believe that the background of our partners sets us apart. We genuinely want to improve people's lives through real estate.

_20220506-4.png)